A Look Into The Markets

This past week interest rates ticked higher in response to a surprise rate hike from above our Northern border. Let's discuss what happened and talk about the big week ahead.

"Well Surprise, Surprise, Come on Open your Eyes" - Surprise, Surprise by Bruce Springsteen

Oh Canada

As the saying goes, "Where there's smoke there's fire". A big news story this past week was the Canadian wildfires raging and sending smoke, affecting nearly 100,000,000 American citizens. But that was not the only big news coming out of Canada.

On Wednesday, in a surprise move, the Bank of Canada raised interest rates by .25%. This lifted their benchmark rate to the highest level in 20 years. In response, interest rates around the globe crept higher. The main concern? This surprise rate hike came after two consecutive meetings where the bank of Canada did not raise rates. There was immediate market fear that our Federal Reserve might do the same.

In recent weeks, the Fed has signaled they are going to pause and not raise rates next week. The Fed has also said there could be a "skip", where they do not raise rates in June, but they come back and raise rates in July, if needed. The markets have ignored the idea of a skip, until Wednesday, when the Bank of Canada raised their rates.

As of this moment, there is a slim chance the Fed lifts rates next week. But come July there is a 66% chance the Fed raises rates once again. There will be a lot of important data that will be reported and can affect whether the Fed raises rates or not.

Treasury Refunding

With the debt ceiling now officially lifted, the Treasury Department needs to refund the Treasury General Account, which was depleted during the past several months. The Treasury Department does this by selling bonds to raise money. It has been said that the Treasury needs to sell as much as $1 trillion worth of bonds, bills and notes over the next six months to keep the money moving. There are negative headlines in the media suggesting this will be a big problem and will cause rates to move higher. Keep in mind that in the past, the treasury department sold much more than this, and in a shorter time frame, so history is repeating itself.

Bottom line: Interest rates remain elevated and near important technical levels as we enter a week full of market moving news.

Looking Ahead

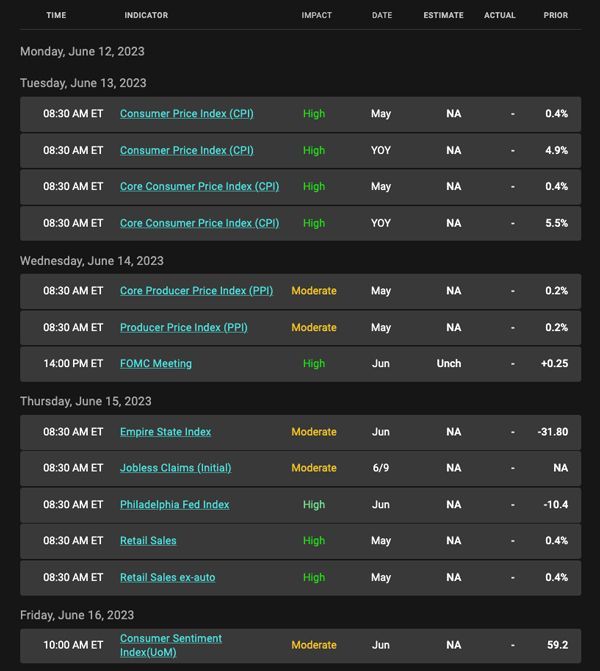

Next week is a very important week for the economy and interest rates. On Tuesday, the Consumer Price Index (CPI) for May will be released. CPI is currently running at 4.9% year over year. There should be some good news over the next couple of months as last May and June high inflation readings will be replaced with the lower ones this year. This means we should see the current 4.9 inflation rate fall to the low 4% range or lower by mid-July when June's number is reported. This news will hit in advance of the late July Fed Meeting.

Speaking of the Fed, on Wednesday the Fed will release their monetary policy statement and interest rate decision. As we shared above, the markets do not expect a rate hike. Word of caution, the markets didn't expect Canada to raise rates either this past week.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 5.5% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

Recently, you can see on the right side of the chart how prices bounced off support at 99. If prices remain above 99, it will represent a near-term peak in rates. The opposite is true.

Next week's high impact events may very well determine whether rates remain above 99 or not.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, June 9, 2023)

Economic Calendar for the Week of June 12 - 16

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

Registered Mortgage Broker-NYS Department of Financial Services

All mortgage loans arranged with third party providers.

NYS, CT, NJ, FL Department of Financial Services

Bob Moulton, Mortgage Broker | All Rights Reserved | Accessibility & Privacy Policy | Powered by PS Digital