A Look Into The Markets

This week the Federal Reserve decided to pause their string of rate hikes for the first time in 15 months, yet long term rates moved higher.

Let's discuss what happened and look at the events to watch for next week.

"Going to keep on trying, 'Til I reach my highest ground" - Higher Ground by Stevie Wonder

Higher For Longer Still

On Wednesday, the Federal Reserve made a decision to not hike the Fed Funds Rate, breaking a string of 10 consecutive hikes, leaving the rate in a range of 5 to 5 1/4.

This move was widely expected by the financial markets. However, the markets were delivered a surprise when The Fed announced its members believe there will be two more rate hikes this year. Heading into the meeting, it was speculated that the Fed may raise rates one more time in July. This additional hike caused a lot of volatility with a spike in short term and near term rates here and abroad.

The Fed Outlook

Every three months, the Federal Reserve releases a Summary of Economic Projections which gives the markets a sense of what Fed members are seeing regarding economic growth, inflation, unemployment, and where interest rates are headed. The forecast shows economic growth coming in slightly stronger than previously expected, but still at a historically slow 1%. Core inflation, which strips out food and energy, is expected to be higher than previously forecasted. Unemployment is forecasted to come in lower than originally expected. Lastly, many Fed members believe interest rates will need to go higher to cool off the labor market to reach the Fed's inflation target of 2.00%

The Press Conference

After the Fed statement was delivered, Fed Chair Jerome Powell held a press conference, where he took questions and tried to give more color as to what Fed members have been thinking. Within the press conference the Fed Chair did say they have not talked about the July rate hike, and the next meeting will be a "live meeting" where they will respond to the economic data in advance of that report. This means, if inflation continues to come down as it has and the unemployment rate edges up like it did last month, the Fed may very well pause rate hikes again at the July Fed meeting. As of this moment, the chance of a Fed hike in July stands at 75% probability.

What It All Means

After all the smoke cleared from the Fed Meeting, we are left with more of the same...uncertainty and volatility around how far the Fed will go with interest rates and where the economy is headed.

Rate Hikes Around the Globe

Last week other Central Banks increased their rates, including the Bank of Canada's surprise rate hike. And this past Thursday on the heels of our Fed rate hike, the European Central Bank (ECB) raised their rates to the highest level in two decades. As rates around the globe go higher, it puts upward pressure on our rates. The opposite is true.

Bottom line: It may be tough to see long-term interest rates improve much in the near term as the markets digest the notion that the Fed will potentially raise rates two more times, with no rate cuts this year. Be sure to watch the data and work with your experienced loan officer who follows this closely.

Looking Ahead

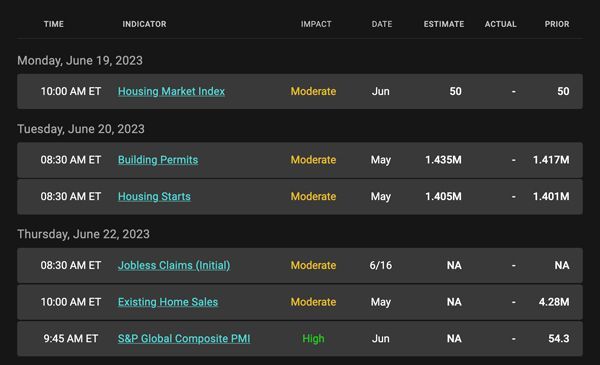

Next week doesn't have a packed economic calendar, but there will be plenty of headline risk as Fed officials start speaking and presenting. There are several Fed members who are calling for at least two more rate hikes and as they speak and defend their position, the market could move quickly.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 5.5% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

You can see on the right side of the chart how prices bounced off support at 99 and edged higher. Staying above 99 will confirm the rate peak for this year is in place.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, June 16, 2023)

Economic Calendar for the Week of June 19 - 23

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.