This past week, interest rates rose once again, reaching the highest level since July. Let's discuss what happened as we enter the final days of 2024.

“I found out long ago (Oh-oh-oh-oh-oh) It's a long way down the Holiday Road - Holiday Road by Lindsey Buckingham.

1.00% For 1.00%

Back on September 18th, the Federal Reserve started cutting rates and has since lowered the Fed funds rate by 1.00%. Since that time, the 10-year Note yield has risen by 1.00%.

Why? The Federal Reserve controls short-term rates, so their rate cuts only affect loans that are short-term in nature. Long-term rates like mortgages react more strongly to the effects of inflation, economic growth, and fiscal policy. When the Fed started cutting rates, inflation was picking up from the second quarter to the third quarter, so the market could be sensing that the Fed is making a policy error by cutting rates when it is unnecessary.

In addition to inflation not yet being at the Fed's 2.00% target, unemployment remains low at 4.2%, and economic growth remains steady at 2%, so the bond market is questioning: Why are you cutting rates when things aren't so bad?

Bonds Sales Not Good

The U.S. government has an excessive amount of debt at 36 trillion, but the real threat, according to Federal Reserve Chair Jerome Powell, is not the existing debt but the current trajectory of new debt.

The government doesn't have enough money to fund its operations, so it needs to sell bonds to raise money, and it does so every couple of weeks in the bond market.

This past week, the Treasury Department sold $183 billion worth of Treasury notes with 2, 5, and 7 year maturities. The overall buying appetite was not good, which added to the upward pressure on mortgage rates.

Looking ahead to 2025, many people focus on the Federal Reserve to help lower mortgage rates. However, our attention should be on the new fiscal policies introduced by the incoming administration. Long-term rates will also react to decreased inflation and reduced deficit spending.

2024 Treasury Yield Highs

The 30-year Treasury bond yield matched its 2024 highs of 4.82% this past week in response to inflation fears and weak Treasury auctions. The 10-year note, a proxy for mortgage rates, also ticked up to 4.64% and is approaching the 2024 highs of 4.74%.

Unemployment Rising

The last Initial Claims report for 2024 was released on Thursday. It showed a low number of people initially seeking unemployment benefits, which was good. However, the number of people accepting unemployment benefits for longer than one week increased to the highest level in three years. Bonds, which typically improve on bad news, were not able to improve based on this data point.

Bottom Line: Rates have continued to creep higher ever since the Fed started cutting rates, as fear of reaccelerating inflation persists. Going forward, the incoming economic data will be crucial to follow, and any weakness in inflation or unemployment will help rates - the opposite is also true.

Looking Ahead

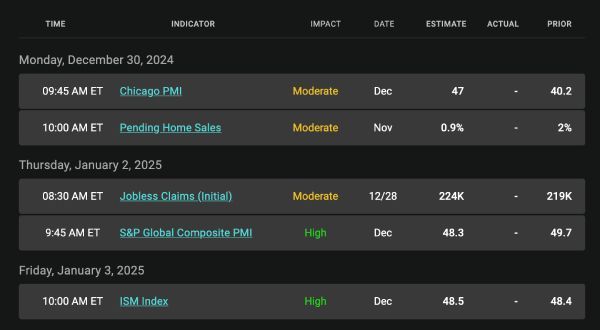

Next week, the economic calendar is light with only a few economic reports. There will be no Treasury auctions to move the market and little in Fed speak. The markets will also be closed on Wednesday, January 1st, for New Year's Day.

Mortgage Market Guide Candlestick Chart Mortgage bond prices determine home loan rates. The chart below shows a one-year view of the Fannie Mae 30-year 6.0% coupon, where currently closed loans are being packaged.

As prices move higher, rates decline, and vice versa. If you look at the right side of the chart, you can see how prices have declined to the lowest levels since July 4th, meaning these are the highest mortgage rates since July.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below shows a one-year view of the Fannie Mae 30-year 6.0% coupon, where currently closed loans are being packaged.

As prices move higher, rates decline, and vice versa. If you look at the right side of the chart, you can see how prices have declined to the lowest levels since July 4th, meaning these are the highest mortgage rates since July.

Chart: Fannie Mae 30-Year 6.0% Coupon (Wednesday, December 27, 2024)

Economic Calendar for the Week of December 30 - January 3

Registered Mortgage Broker-NYS Department of Financial Services

All mortgage loans arranged with third party providers.

NYS, CT, NJ, FL Department of Financial Services

Bob Moulton, Mortgage Broker | All Rights Reserved | Accessibility & Privacy Policy | Powered by PS Digital