A Look Into the Markets

Home loan rates reached their best levels in two months on the heels of not-so-good news. Let's get into what happened and look into the week ahead.

"I see hurricanes and lightning" Bad Moon Rising by Creedence Clearwater Revival

Bad News is Good News for Rates

The JOLTS (Job Openings and Labor Turnover Survey) report, a leading indicator on the health of the labor market, showed signs of cooling. It revealed 9.8 million jobs available, 700k less than expected and the first reading under 10 million in three years.

If you consider how the labor market works for example, first firms stop hiring, then they cut hours and then if conditions persist, they lay people off. So, this could be a sign to the Fed that the labor market is finally showing some signs of slowing down, which is what they want to help lower inflation.

The good news? While the number of jobs available came in well below expectations, we are still seeing 1.6 jobs available for every person unemployed, which is indicative of a tight labor market.

Dimon Jawboning

Earlier this week, JPMorgan Chase CEO Jamie Dimon, shared his annual thoughts with shareholders. He stated that the problems in the banking sector are far from over and the chance of recession is elevated. Over the last several months, Mr. Dimon did suggest the economy was headed into an economic hurricane and then backed off that gloomy stance and suggested we might not see a recession. Now he is firmly back in the recession camp and upon his headlines, rates improved and stocks didn't.

Manufacturing is Not Manufacturing

The ISM Manufacturing index, which is a reading of our national manufacturing production, came in at 47. Readings beneath 50 suggest contraction or shrinking of production. This is not a good number and because bonds and rates like numbers that are not good, they rallied.

3.26%

During the week, the 10-year Note yield hit 3.26%, the lowest since September. Most importantly, as of press time, the 10-year yield fell well below its 200-day Moving Average. History has shown that when the 10-year moves convincingly beneath its 200-day Moving Average, it leads to better rates in the weeks and months ahead.

Bottom line: With signs of a recession looming in the months ahead and if inflation continues to decline, it could push home borrowing costs lower and buoy the spring buying season.

Looking Ahead

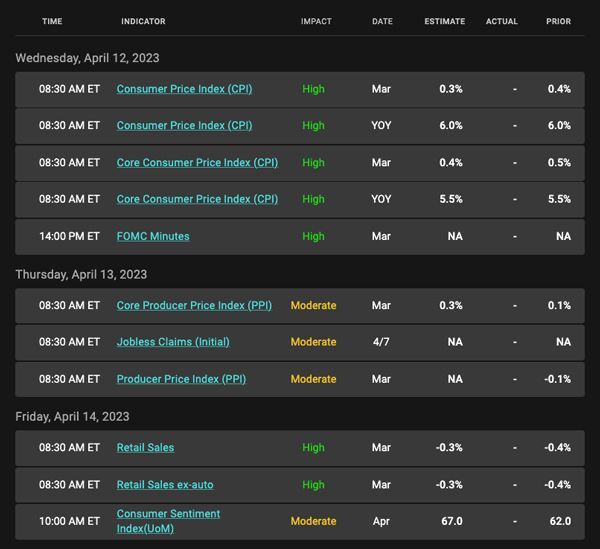

The upcoming week will feature the closely watched inflation reading Consumer Price Index for further signs of a cooldown. The index hit 9% in June of 2022 and has fallen to 6% though still historically high. Also, wholesale inflation from the Producer price Index will be released along with a key gauge on consumer spending with the Retail Sales report.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices determine home loanrates. The chart below is a one-year view of the Fannie Mae 30-year 5.5% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

If you take a look at the right side of the chart, you can see MBS breaking above its 200-day Moving Average. If this trend continues into next week, we could expect lower rates ahead. The opposite is true.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, April 7, 2023)

Economic Calendar for the Week of April 10 - 14

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.