A Look Into The Markets

This past week, home loan rates ticked higher from the previous week in response to no dire news in the banking sector. Let's walk through the Fed Meeting and the other big events impacting the markets.

"Going up, down, up, down, up, down"- Up Down by Morgan Wallen

Contagion Fears Subside

No news was good news for stocks and bad news for bonds and interest rates. After two weeks of multiple bank collapses and central bank intervention, fears of contagion leading to other banks has eased a bit.

This removal of fear pushed home loan rates higher after they touched the best levels in over a month. And stocks which like less risk, enjoyed solid gains throughout the week.

Pending Home Sales Bodes Well for Housing

The February Pending Home Sales Index, a leading indicator for the housing sector, grew for a third straight month. It appears that housing sales may have bottomed as demand remains strong. With the Fed nearing the end of its rate hiking cycle, long-term rates having already peaked and the labor market still resilient, it all adds up to a bright outlook for housing.

Economic Growth Slowed into 2023

The final revision for 4th Quarter 2022 GDP came in at 2.6%, which was a slowdown from the 3rd Quarter 3.2% rate. The final GDP rate for 2022 was 2.1%...a sharp slowdown from the 5.9% rate in 2021.

The evidence of slowing growth may be music to the Fed's ears as they hope their previous rate hikes will slow the economy enough to lower inflation, while achieving a "soft landing" and where we could avoid a deep recession.

Home Price Gains Slowing is Good News

The Case-Shiller Home Price Index showed the broad-based 20-City Composite posted a 2.5% year-over-year gain in January, down from 4.6% in the previous month.

"2023 began as 2022 had ended, with U.S. home prices falling for the seventh consecutive month," says Craig J. Lazzara, Managing Director at S&P DJI.

This is yet another data point the Federal Reserve is happy to see. The Fed wanted to slow down housing and cool price gains, which make up a large portion of overall inflation. This backward and lagging indicator should help lower inflation in the months ahead.

50/50

As of press time, the easing bank fears have slightly elevated the chance of a .25% rate hike in May to 50%. The Fed had forecasted at the last meeting they will get the Terminal Rate, a fancy way to say peak in Fed Funds Rate to 5.1%. One more .25% rate hike will achieve this. With so many important economic reports and uncertainty in the banking sector, this story can change quickly.

Bottom line: With mortgage rates now near the levels seen in early February, when home sales jumped, there are signs the Spring housing market may be better than expected than just a couple of weeks ago.

Looking Ahead

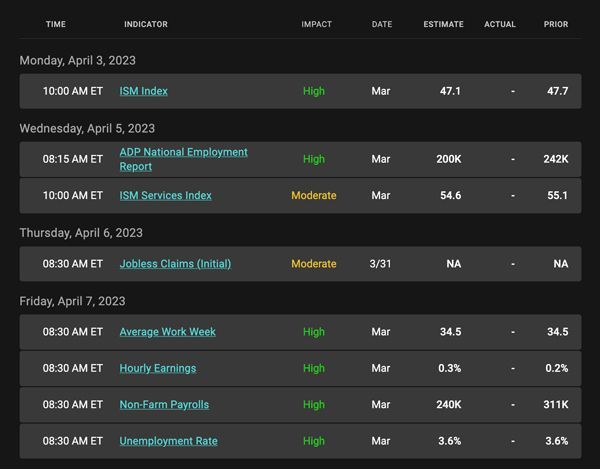

Next week it will be about jobs. We will get the ADP Report and the official Jobs Report for March, next Friday. Last month we saw the unemployment rate tick up to 3.6% from 3.4% in the previous month. A further uptick in unemployment would lower expectations for more rate hikes.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 5.5% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

MBS prices have backed away from their 200-day Moving Average. For rates to improve much further, we need to see prices break above this technical barrier.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, March 31, 2023)

Economic Calendar for the Week of April 3 - 7

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.