A Look Into The Markets

This past week, the minutes from the July Fed Meeting were released. The news didn't help home loan rates, which ticked up to the peaks of last year. Let's look at what happened and talk about the headline risk in the week ahead.

"Here I go again on my own. Going down the only road I've ever known" Here I Go Again by Whitesnake

"Uncertainty of the U.S. economic outlook remains elevated"... FOMC minutes from the July Fed Meeting.

The Fed Minutes kicked off with this statement, which sums up the last 18 months. It remains unclear if inflation will continue to come down, if the Fed will continue to hike rates and if the economy can avoid a recession. And for all of these reasons, interest rates have been volatile with no clear signs of stability.

"Most participants (Fed Members) saw continued significant upside inflation risks "

This line was like kryptonite to Superman as bond/interest rates hate inflation. The fact that we are still enduring significant upside risk was enough for bonds to sell off and push rates higher.

"Participants still saw below-trend growth, softer labor market as necessary to restoring economic balance."

Here the Fed is reminding the markets that they want to keep rates higher for longer until unemployment rises further, and the economy potentially slows further. Looking into the months ahead we should expect continued slower economic growth and price highs but continuing to come down slowly. For this reason, we should expect home loan rates to also retreat lower and slowly.

The good news? After all this uncertainty and tough talk on inflation, the markets are currently pricing the probability of a Fed rate hike in

September at just 11%. However, more data will come in which could change things. But as of now, the Fed is not going to hike rates.

Bottom line: Rates have ticked higher on the heels of our recent debt downgrade and uncertainty around inflation and no recession. Maybe next week things change...read on.

Looking Ahead

Next week brings the Jackson Hole Symposium, with our Fed Chair Jerome Powell speaking on Friday. History has shown this event could typically generate big market and interest rate moves. While there will be plenty of other headline risk and reports throughout the week, they are second fiddle to this event...stay tuned.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 6.0% coupon, where currently closed loans are being packaged. As prices increase, rates move lower and vice versa.

Prices have now touched levels last seen in 2009. Next week's Jackson Hole event may determine whether rates continue to rise or if the Fed says something important to help rates stabilize and possibly recover.

Chart: Fannie Mae 30-Year 6.0% Coupon (Friday, August 18, 2023)

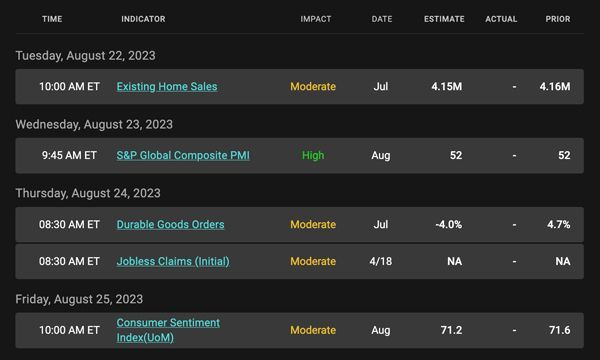

Economic Calendar for the Week of August 21 - 25

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

Registered Mortgage Broker-NYS Department of Financial Services

All mortgage loans arranged with third party providers.

NYS, CT, NJ, FL Department of Financial Services

Bob Moulton, Mortgage Broker | All Rights Reserved | Accessibility & Privacy Policy | Powered by PS Digital