A Look Into the Markets

Home loan rates continue to stabilize ahead of next week's Fed Meeting. Let's discuss what happened this week as we await yet another Fed rate hike next Wednesday.

"Little Pink Houses for You and Me"... Little Pink Houses by John Mellencamp.

New Home Sales Soared In March

Housing continues to show some positive signs lately, thanks to the decline in mortgage rates. This week, New Home Sales for March grew by 9.6%, when the markets expected a 1.6% decline. The sales pace remains 3.4% lower than in March of 2022 but the improvement we are seeing since the beginning of the year highlights the strong demand for housing coupled with interest rate sensitivity.

The Northeast saw the largest pickup in sales. Warm weather could have helped fuel the buying activity. Builders also used incentives and buydowns to close deals.

Home Prices Rise - First Time In Eight Months

The S&P CoreLogic Case-Shiller National Home Price Index rose month over month in February, breaking a string of seven consecutive months of declines.

The Federal Housing Finance Agency also reported a price rise for February. What is sparking the increase in prices in what overall remains a slower housing market? Low housing inventory and a nice decline in home loan rates since the peak in October.

The home price gains continue to decelerate and this is good for restoring market balance as well as helping lower future inflation readings.

First Republic - The Next Bank Problem?

Weeks after the SVB collapse, First Republic Bank, despite multiple bailouts, is said to be on the brink of failure. There is some speculation that measures might need to be taken over the weekend to help the Bank survive.

This story reignites uncertainty around financial stability as we approach next week's Fed Meeting. Higher short-term rates, controlled by the Fed, only make problems worse for the banks. The Fed's comments on the banks next week will be market-moving.

Technical Barriers To Further Rate Improvement

Mortgage and housing professionals monitor both macroeconomic conditions, as well as technical factors (chart signals), to help determine rates trends and changes to them.

Currently, the 200-day Moving Average is limiting further rate improvement in the 2-year Note yield and the 10-year and mortgage-backed securities (where home loan rates are derived).

Next week's Fed Meeting, where it is widely believed the Fed will end this rate hiking cycle, could be the trigger to push bond prices above this ceiling.

One thing for sure? Rates can't improve further until prices break through this barrier. And if they do, we could very well see another leg lower in rates.

Bottom line: Home loan rates have peaked, inflation has peaked and next week the Fed rate hikes are likely finished. Couple this with the bright future in housing and it's a reason to go shopping today.

Looking Ahead

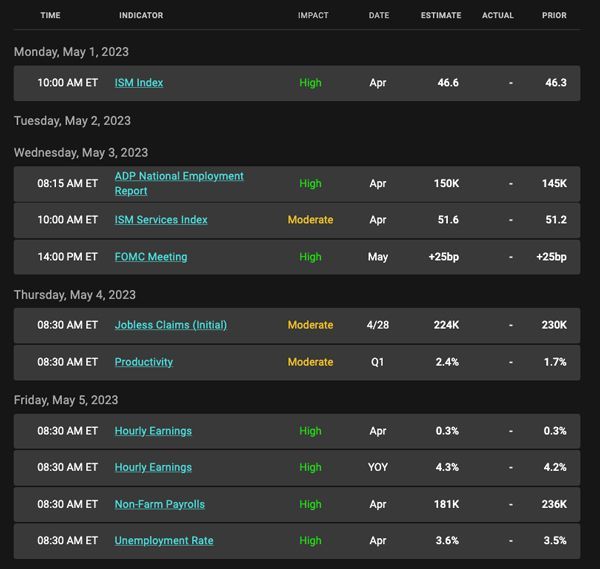

Next week is a big week for the mortgage and housing world. On Wednesday, the Fed is going to raise rates by .25%, lifting the Fed Funds Rates to a range of 5 to 5.25%. This event will garner multiple market reactions. And if that were not enough headline risk, we have the April Jobs Report out next Friday. The current tight labor market is wonderful for housing and is a reason why the economy can't endure a deep recession.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 5.5% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

The Purple line is the 200-day Moving Average, as we mentioned earlier. Until MBS break above this ceiling at the 200-day MA, mortgage rates can't improve further but once it does, we could see bonds blast off and help rates move lower to another level and move quickly.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, April 28, 2023)

Economic Calendar for the Week of May 1 -5

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

Registered Mortgage Broker-NYS Department of Financial Services

All mortgage loans arranged with third party providers.

NYS, CT, NJ, FL Department of Financial Services

Bob Moulton, Mortgage Broker | All Rights Reserved | Accessibility & Privacy Policy | Powered by PS Digital