A Look Into The Markets

This past week the Federal Reserve raised rates for the 10th time in a little over a year. Let's discuss what happened as we await yet another Fed rate hike next Wednesday.

"Was it something I said or something I did? Did the words not come out right?" Every Rose Has Its Thorn by Poison.

The Last Hike?

As we expected, the Federal Reserve raised the Fed Funds Rate to a range of 5.00% - 5.25%. Remember, this interest rate affects short-term loans like credit cards, autos, and home equity lines of credit.

The big question is whether this will be the last hike. When the Fed statement was released, the markets believed the Fed was signaling a pause by omitting the following line from the previous statement: "The Committee anticipates that some additional policy firming may be appropriate."

However, shortly after the statement was released, Fed Chair Powell hosted a press conference and right at the top said the Fed Members have not discussed a "pause" in rates. Bottom line? Expect more uncertainty and volatility as it relates to rates.

Sound And Resilient

This is the term Fed Chair Powell used to describe the banking sector. Unfortunately, we are seeing more banks have issues. This week it was First Republic taken over by JP Morgan Chase and as of this writing PacWest was said to be "exploring strategic options." The fear of banking contagion has elevated uncertainty in the financial markets. It's not clear if and how many more banks will continue to have issues. Bottom line? The fear of this story has created a "safe haven" to trade into bonds where prices move higher, and rates move lower.

European Central Bank Hikes By Less

The European Central Bank (ECB) hiked their benchmark rate by .25%, the smallest since the start of their hiking cycle. Like our Fed, they too signaled they would be "data-dependent" going forward, leading markets to speculate a pause on future rate hikes.

Bottom line:

The Federal Reserve is sending mixed messages on the future direction of rates. Meanwhile, long-term rates, which the Fed doesn't control, are near their best levels in months and sense all the uncertainty in our economy will prompt the Fed to pause and potentially cut rates later this year. The incoming data and issues in the banking system will determine what happens next.

Looking Ahead

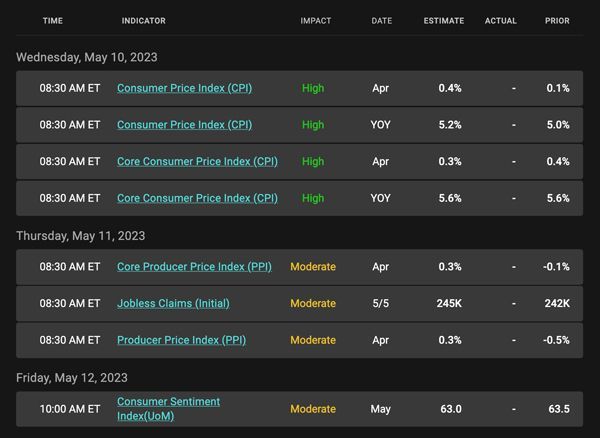

Expect market volatility to continue next week. The Consumer Price Index (inflation) will be reported. If this number comes in higher than expected, rates could rise. The opposite is true. Despite this being a backward-looking number, we will have Fed officials continue to speak and comment on the release and how they feel it impacts future Fed policy and interest rate decisions.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 5.5% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

The purple line is the 200-day Moving Average, we mentioned earlier. Until MBS break above this ceiling at the 200-day MA, mortgage rates can't improve further but once it does, we could see bonds blast off and help rates move lower to another level quickly.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, May 5, 2023)

Economic Calendar for the Week of May 8 - 12

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.