A Look Into The Markets

This past week interest rates touched the best levels of 2024. Let's discuss what happened and look into the week ahead.

"You dropped a bomb on me baby, you dropped a bomb on me" - You Dropped a Bomb on Me - The Gap Band.

Fed Minutes Released

A big market mover this past week was the release of the Minutes from the July Fed Meeting three weeks ago. At that meeting, Fed Chair Powell suggested rates could be cut in September if "more good data" on inflation was released. He also reiterated that the Fed could change its position and potentially cut rates further if they saw "unexpected weakness" in the labor market.

Well, three weeks later, the headline from the Minutes suggested that several Fed officials preferred to cut rates at the July meeting.

Since that Fed meeting just a few weeks ago, we received the July Jobs Report which showed a sizable uptick in the unemployment rate to 4.3%. Moreover, this triggered the Sahm Rule which shows a 0.5% rise in unemployment in a year. We witnessed unemployment rise from 3.5% to 4.3% from July 2023 to July 2024.

Negative Jobs Report Revision

On Wednesday of last week, the Bureau of Labor Statistics (BLS) submitted a sizable downward revision on job creations between March 2023 and April 2024. Throughout last year and into this year, the BLS reported there were 818,000 less jobs created or roughly 68,000 less jobs created per month for the year.

While this is backward looking, this enormous downward revision is a concern that the labor market is already weaker than previously believed. Additionally, with the Sahm Rule triggered, talk of a recession or economic slowdown, has gained steam.

Poising For a Breakout

With rates at the best levels of the year and incoming economic news showing signs of weakness, we could be on the cusp of another move lower in interest rates.

In addition to the trend of rates which you could see below in the chart section, the Federal Reserve is going to cut rates for the first time in years come September.

Bottom line: Interest rates continue to improve, and the current trend remains our friend. Incoming economic news can derail this trend if it might prevent the Fed from cutting rates as often as currently being priced.

Looking Ahead

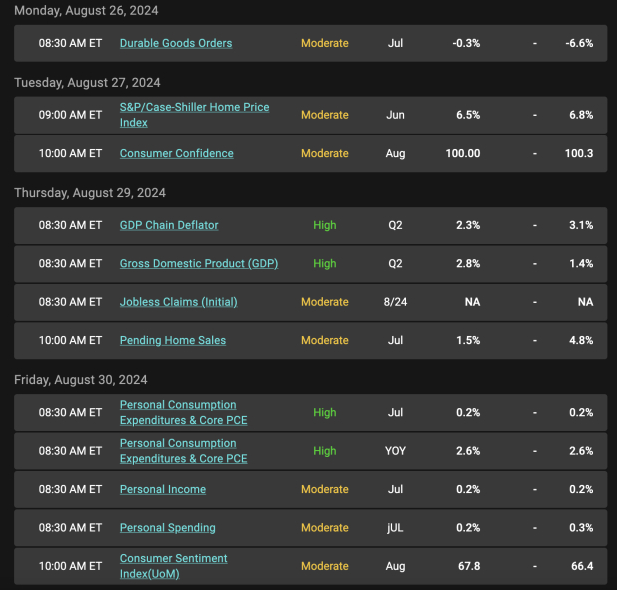

Next week is a huge week for interest rates. On Friday, the Fed's favored gauge of inflation, the Core Personal Consumption Expenditure (PCE) index, is set to be released. Currently inflation is running at 2.6% and moving towards the Fed's target of 2%. A reading at or lower than expectations could be good for rates. The opposite is true.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 6.0% coupon, where currently closed loans are being packaged. As prices move higher, rates decline, and vice versa.

If you look at the right side of the chart, you can see how prices have steadily improved since April and the trend remains our friend.

Chart: Fannie Mae 30-Year 6.0% Coupon (Friday, August 23, 2024)

Economic Calendar for the Week of August 26-30

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

Registered Mortgage Broker-NYS Department of Financial Services

All mortgage loans arranged with third party providers.

NYS, CT, NJ, FL Department of Financial Services

Bob Moulton, Mortgage Broker | All Rights Reserved | Accessibility & Privacy Policy | Powered by PS Digital