A Look Into The Markets

Inflation perked up, yet interest rates improved from key levels. Let's walk through the big financial news of the week as we approach next Wednesday's Fed Meeting.

"Yeah, it's coming up. Coming up, on the hour" Coming Up by Paul McCartney

Tale Of Two Inflations

Last Wednesday, the Consumer Price Index (CPI) for August increased by 0.6% for the month, lifting the annual rate to 3.7%, both of which were higher than expected. The month-over-month rise was the highest this year. The main culprit? Energy. Oil soared by nearly 11% for the month as a barrel has gone from $65 to $89 between June and September.

The Core CPI, which excludes food and energy and is more closely watched by the Federal Reserve, did decline to 4.3% from 4.7% year-over-year and appears to be trending in the right direction...lower.

The bond market and interest rates must have liked the decline in Core CPI as the post-news reaction watched the 10-year Note yield decline from 4.35% down to 4.25%.

Oil Hits 2023 Highs

As mentioned, oil prices were the main reason for inflation rising in August. Prices have continued their rise this month with a barrel hitting 2023 highs last week. Should it continue, we should expect the September CPI to also show headline inflation remaining high and confirm that inflation bottomed this June.

The Blackout Period Continues

With the Fed Meeting approaching this coming week, Federal Reserve officials do not make any speeches or comments on monetary policy. This quiet or calm before the storm helped lower interest rate volatility and kept rates from moving above 2023 peaks. All this will change next week.

As of this moment, Fed Fund Futures, which price the probability of interest rate moves are showing a nearly 100% chance of no rate hike at this Meeting.

Japan Interest Rates Climbing Too

Interest rates around the globe have moved higher and now Japan has joined the club. With inflation in the region hitting 40-year highs, their Central Bank has allowed their 10-year government bond to touch .70%, the highest level since 2014. It appears their central bank could allow this interest rate to rise further. If it does, it could apply upward pressure on all global yields, including our 10-year Note.

Bottom line: Interest rates remain near the highest levels of the year and there is a threat of headline inflation reaccelerating, due to energy prices. This will be important to watch in the months ahead because if inflation moves higher, it may force the Fed to hike rates further.

Looking Ahead

This coming Wednesday, the Federal Reserve will release its Monetary Policy Statement and interest rate decision. Just prior to the Blackout period, where officials do not comment. Several Fed Members talked about the need to be "patient" and likely "pause" further hikes and wait to see how the economy evolves. Those terms, along with coinciding economic data do have the markets sensing no rate hike this coming week and a 50/50 chance of one in November.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 6.0% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

On the right side of the chart, you can see how prices are trying to stabilize above 2023 price lows, which could lead to further rate improvement if it continues. However, should the Bond move beneath $99, it would likely lead to another leg higher in home loan rates.

Chart: Fannie Mae 30-Year 6.0% Coupon (Friday, September 15, 2023)

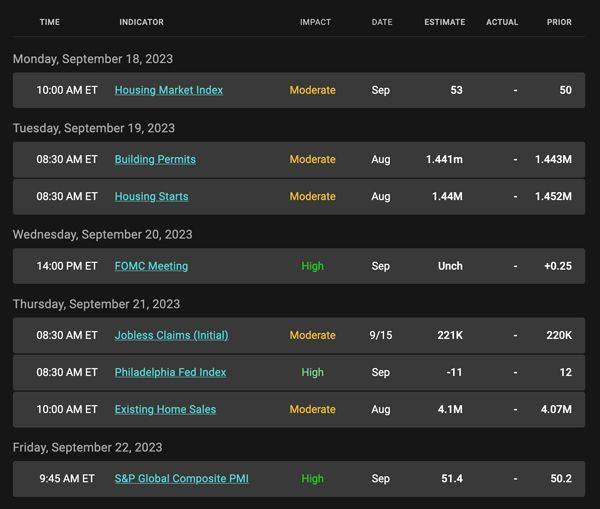

Economic Calendar for the Week of September 18 - 22

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.