A Look Into The Markets

This past week mortgage rates held near the best levels of the last several months in response to the lowest inflation reading in two years. Let's discuss what happened and have a look at next week.

"Lighten up while you still can. Don't even try to understand". Take it Easy by The Eagles

Inflation Moving Lower

The Consumer Price Index (CPI) for April, a closely watched reading on consumer inflation, was reported at 4.9% year over year. This was lower than what was expected and the lowest reading since April 2021.

Last year the CPI was running above 9%, so seeing annual readings under 5% is a welcome sign.

There is a reason to be optimistic about lower inflation ahead. Shelter, which includes rent, makes up a sizable portion of CPI. That figure, which is lagging as declines in rent take time to hit the CPI report, are finally appearing in the report. We should expect the shelter component to continue lowering inflation later this year and into 2024. This will help keep long-term rates (like mortgage rates) all beneath current levels.

1.5%

The softening inflation reading is adding to the idea that the Fed should pause on rate hikes in June. As of right now, the financial markets are pricing in just a 1.5% probability that the Fed will hike rates at their next meeting in June.

After the fastest rate hiking cycle in 40 years, this would be welcome news. Despite Fed officials saying otherwise, the financial markets are also pricing in a high probability of multiple Fed rate cuts in the second half of this year. If inflation cools further and unemployment starts to rise, this may come to pass.

Debt Ceiling Debacle

Add one more uncertain event to our economy, and it is the debt ceiling debate taking place in Congress. Essentially, we will reach the limit to what our government could spend as early as next month. This means Congress has to agree to raise the limit regarding what we could spend, or we risk a potential debt default and credit downgrade like we watched in 2011.

Most everyone believes that aside from the political grandstanding and bickering back and forth, a deal will get done to ensure the U.S. doesn't default on its debt. However, in the near term it could cause increased volatility, and potentially an uptick in rates, including mortgage rates, as the threat of a downgrade rises.

Sell In May

After a rough 2022, stocks have enjoyed a couple of strong quarters of gains. Now we enter the summer months and the old adage "sell in May and go away" is gathering steam. Essentially, the idea is to sell stocks in May and re-enter the market later in the year. Why is this important? If stocks move lower amidst uncertainty, bonds and interest rates will likely be the beneficiary.

Bottom line: This is an important moment for rates. As you will see below in the chart section, there is a pending breakout that could cause yet another fast improvement in rates. Follow this closely and be prepared to strike at any opportunity!

Looking Ahead

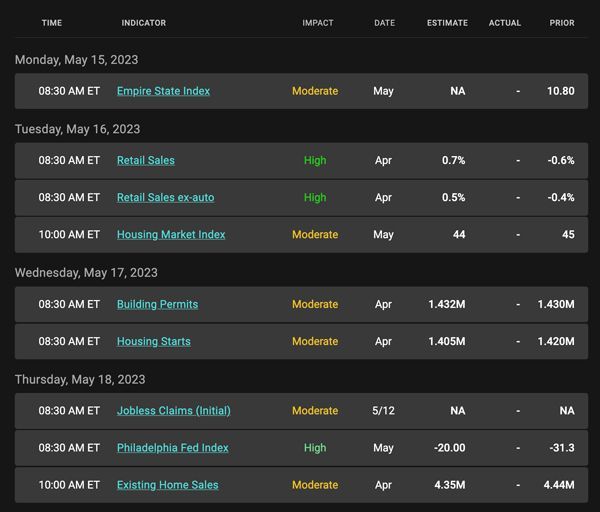

We are continuing to watch the debt ceiling debate and uncertainty within the banking sector. The economic calendar will have readings on Retail Sales, Housing, and regional manufacturing data.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 5.5% coupon, where currently closed loans are being packaged. As prices increase, rates decline and vice versa.

The purple line is the 200-day Moving Average (MA), which we mentioned earlier. Until MBS break above this ceiling at the 200-day MA, mortgage rates can't improve further but, once it does, we could see bonds blast off and help rates move lower to another level and quickly.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, May 12, 2023)

Economic Calendar for the Week of May 15 - 19

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated.

Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.