A Look Into The Markets

Independence Day, also called the 4th of July, is the United States celebration of nationhood. It commemorates the passage of the Declaration of Independence on July 4, 1776. In 1870, the U.S. Congress made July 4th a federal holiday. In 1941, the provision was expanded to grant a paid holiday to all federal employees. The day is celebrated by fireworks, barbecues and spending time with family and friends.

"My country,' tis of thee, Sweet land of liberty, of thee I sing" by Henry Carey.

Inflation Fight Continues

Interest rates continued their sideways trend as we close the first half of 2023. Let's discuss what happened this week and look into the future.

The European Central Bank forum was the main event this week. Central bankers from across the globe, including our Fed Chair, Jerome Powell spoke about the state of their countries economy as well as monetary policy. A common theme was the need to continue to fight inflation, which is still persistently high and above central bank targets.

Here at home, the Federal Reserve's favored gauge of inflation, the Core Personal Consumption Expenditure Index (PCE), is still running in the mid 4.00% range, more than double the Fed's target of 2%. The Federal Reserve recently stated they see inflation coming down to their goal of 2% in 2025. This means we should expect short-term rates to stay higher for longer and a high possibility of no rate cuts this year.

A Breakout is Coming

If you look at the chart section below, you will see Mortgage Bonds have been unable to break above 100. Until this happens, home loan rates simply can't get better. While in the Treasury market, the 10-year Note has a breakout coming. The 10-year yield, currently at 3.80%, sits at the top of a very tight range between 3.68% and 3.83%. Whichever way the yield breaks will likely determine the next directional move for home loan rates. So, this is a story worth following.

Bottom line: Long-term interest rates peaked back in October and have gradually inched lower, making a series of lower highs and lower lows overtime. Looking at the second half of the year, with inflation continuing to moderate and unemployment continuing to rise, we should expect a continued gradual decline in long-term interest rates. Coupled with robust housing demand which has set us up for a much better housing market in the back half of 2023.

Looking Ahead

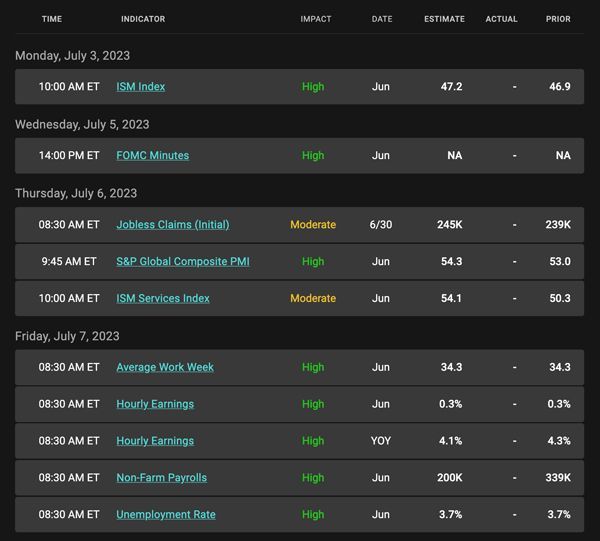

Next week is a short week as we celebrate Independence Day. However, there could be plenty of fireworks come next Wednesday and Friday as the Fed Meeting Minutes and June Jobs Report are delivered.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 5.5% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

You can clearly see how prices have moved sideways beneath resistance at 100 for over one month. Home loan rate improvement from here will be limited in the absence of a break above this tough ceiling.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, June 30, 2023)

Economic Calendar for the Week of July 3 - 7

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.