A Look Into the Markets

A Day of Remembrance

Originally called Decoration Day, Memorial Day was first observed after the Civil War and is in remembrance of those men and women who have died in military service to our country. Memorial Day was declared a federal holiday in 1971 and commemorated on the last Monday in May.

Enjoy the unofficial kick-off of Summer and remember those who perished serving our country.

Debt Ceiling Debate

Failure to reach a deal..."Would be a negative signal of the broader governance and willingness of the U.S. to honor its obligations in a timely fashion and would be unlikely to be consistent with a "AAA" rating" – Fitch rating agency.

As of this press time, there has been no resolution to the debt ceiling negotiations. This event has caused major disruptions in the financial markets, including a spike in interest rates over the last few weeks.

Adding to the uncertainty, the bond rating firm Fitch has put our debt on a negative rating watch. This is a direct threat that if we do not resolve the debt ceiling, a credit downgrade would result.

History Might Be On Our Side

Back in April 2011, our debt was put on negative watch by credit agencies and on August 5th, 2011, our debt was downgraded. What happened at that time? Rates improved.

After a week plus of rates edging higher, maybe this event will start the process of stabilization. If you look at the chart section below, you can see MBS prices were able to remain above support, which means rates stopped increasing.

The lack of resolution on the debt ceiling may be a reason why the Fed may very well pause on hiking rates in June.

Bottom line: As the debt ceiling debate continues unresolved, we should not expect much if any improvement in interest rates.

Looking Ahead

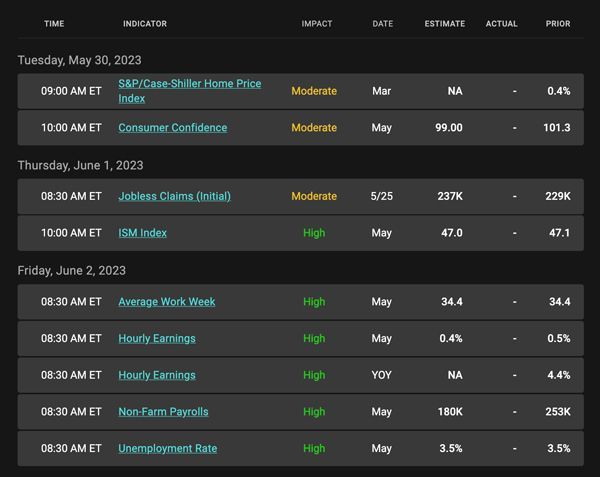

Until resolved, the debt ceiling remains the biggest issue for our economy. But next week will have additional headline risk with Fed speakers and the Jobs Report next Friday.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 5.5% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

You can see on the right side of the chart how prices bounced off support at 99, despite a negative ratings watch. If prices remain above 99, we may have seen the near-term peak in rates. The opposite is true.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, May 26, 2023)

Economic Calendar for the Week of May 28 - June 2

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

Registered Mortgage Broker-NYS Department of Financial Services

All mortgage loans arranged with third party providers.

NYS, CT, NJ, FL Department of Financial Services

Bob Moulton, Mortgage Broker | All Rights Reserved | Accessibility & Privacy Policy | Powered by PS Digital