A Look Into the Markets

This week interest rates improved significantly as the markets responded to the softest inflation reading in over two years. Let's discuss what happened and look at the week ahead.

"Ch-ch-ch-ch-changes, Turn and face the strange, Ch-ch-changes". Changes by David Bowie.

Consumer Prices Are Falling

The Consumer Price Index (CPI) for June was reported on Wednesday and showed that consumer prices are falling, which is wonderful for the interest rate sensitive housing sector. The headline CPI for June, which includes food and energy, came in at 3% year-over-year; the slowest rate since March 2021. It was just last year we were reporting CPI readings of over 9%, so this was a welcome sign for all Americans.

Note: This sizable decline is mainly because oil prices were $70 in June...almost half of what they were last June. It also highlights how important it is to keep oil prices low.

Adding to the good vibes within the report Core CPI, which excludes food and energy, also declined further than market expectations. All this good news on inflation sparked the party in the bond market. The 10-yr Note yield dropped from multi-month highs of 4.09% to 3.83% very quickly.

Fed Members Changing Their Tune

In response to the surprisingly low inflation reading, some Fed members are already suggesting that inflation is approaching "normal levels", while others say we are nearing the end of rate hikes. This is a very different tone that was being shared a couple of weeks ago when Fed members were pounding the table for more hikes and higher rates for longer.

After the dust settled from the report, the markets are pricing in just one more rate hike at the end of July. As we've seen before, this story can and will likely change in the future.

Not Out Of The Woods

This past week's low inflation number was terrific to see, but we are not out of the woods with inflation just yet. In fact, in the next couple of months, we are very likely to see CPI move higher. Why? Because last July and August we had very low monthly inflation readings, which will likely be replaced with higher inflation readings this year, causing inflation to possibly tick higher.

In future months, we will also have to watch the price of oil. If it starts to edge higher from the recent lows, it will elevate inflation much like it did last Summer. We do have production cuts from OPEC and Saudi Arabia next month which may influence prices.

4.09%

Yield resistance is a level which halts or prevents rates from moving higher. Since early November, that level has been 4.09%. If the 10-yr yield moves above 4.09%, it will likely place additional upward pressure on Treasuries and thus mortgage rates. The good news? This past week, the 10-yr yield hit 4.09% a couple of times before edging lower.

Bottom line: Inflation is trending in the right direction which is lower and as this continues, we should expect rates to continue to move lower as well.

Looking Ahead

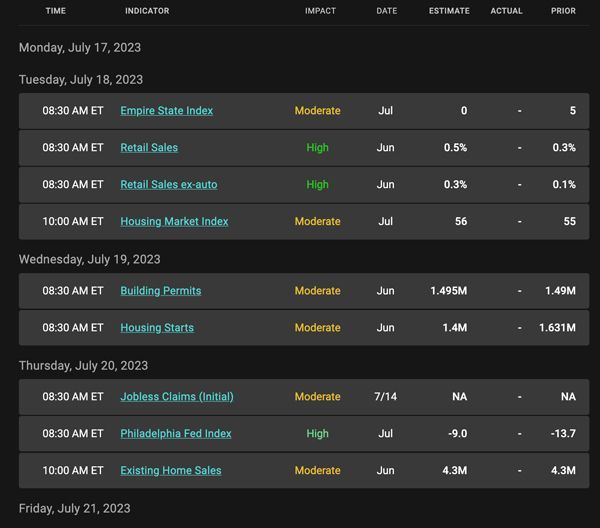

Next week brings some important readings on housing and retail sales. With Fed speakers set to hit the podium, it will be interesting to see if we hear more dovish talk and a sense that rate hikes are drawing to a close.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 5.5% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

After a 5-day rally higher in prices, mortgage bonds are once again testing resistance at 100. If prices move above 100, rates can improve further. The opposite is true.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, July 14, 2023)

Economic Calendar for the Week of July 17 - 21

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.