A Look Into The Markets

This past week, home loan rates improved to their lowest levels in a month in response to the closures of Silicon Valley Bank (SVB) and Signature Bank. Let's walk through what happened as we approach the Fed Meeting next week.

"Bringin' on the heartache, Can't you see?, Can't you see?" Bringin' on the Heartbreak? Def Leppard.

SVB Failure and Rates

It's important to remember that bonds enjoy bad news, so when word broke earlier this week that SVB was shuttered by the FDIC, home loan rates improved to their best level in six weeks. At the same time, the 2-year Note yield, which tracks Fed rate hike activity, plummeted from over 5.00% to under 4.00% in just a couple of days. This was an epic decline in rates not seen even after 9/11 or the Great Recession.

The good news (in the case of SVB and even Signature) is that bad management, failure to manage interest rate risk and a widespread desire for depositors to gain access to their funds (bank run) is what caused these banks to shutter.

In response, the Federal Reserve immediately created a line of credit and an implicit backstop to protect any depositors from any losses. This was good news and will hopefully limit any further fallout in the banking sector.

So, what does the Fed do with rates now that we have high uncertainty and contagion risk in the banking sector?

Stability > Inflation

Seeing that one reason SVB failed was in response to a rapid rise in interest rates, there is increased pressure for the Fed to limit rate hikes going forward and regain stability in the financial sector.

Just last week there was a high probability the Fed would raise rates by .50. Now just days later, there is a 75% chance of a .25% and a 25% chance the Fed doesn't hike rates at all.

Next week's Fed Meeting and press conference will hopefully have the markets feeling that the Fed is going to take every measure possible to ensure stability while they closely watch the pace of inflation decline.

Housing Numbers OK

It wasn't all bad news this week. Housing numbers for February highlighted the little rate relief we saw in January and brought some optimism into February. Both Housing Starts (which is putting the shovel in the ground), and Permits (a leading indicator of future building), came in better than expectations.

This bodes well for housing in the months ahead, especially combined with the rate relief we are experiencing.

Bottom line: This week's news in banking has changed everything as it relates to the Fed and rate hikes. The markets are suggesting the Fed will be cutting rates in the second half of the year which is a big change from the rate outlook just days ago.

Looking Ahead

Next week brings the Fed Meeting and monetary policy decision. As we shared, it appears the Fed is only going to raise rates by .25%, rather than .50% to foster stability in the financial markets and avoid contagion in the banking sector. What the Fed says will be important in bringing calm to the markets during this uncertain moment.

Mortgage Market Guide Candlestick Chart

Mortgage Market Guide Candlestick Chart Mortgage-backed security (MBS) prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 5.5% coupon, where currently closed loans are being packaged. As prices move higher, rates move lower and vice versa.

MBS prices have moved sharply high over the last several days, providing a nice improvement in rates. For rates to improve further, we need to see MBS push above $101, where they started at the beginning of February. A move above this ceiling would lead to another pop higher in rates.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, March 17, 2023)

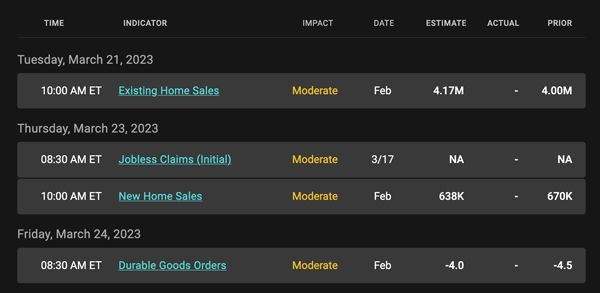

Economic Calendar for the Week of March 20 - 24

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.