A Look Into The Markets

This past week home loan rates ticked higher in a week filled with some negative surprises. Let's discuss what happened and look at the week ahead.

"Money, so they say – Is the root of all evil today"...Money by Pink Floyd

Another $1T Please

Earlier in the week, the Treasury Department surprised the financial markets when they stated they need $1T to fund the government from August to October. The problem? It was $275B more than what was expected just a few months ago when the Treasury last released their funding expectation needs.

How does the Treasury Department raise the $1T? By selling Treasury Bills, Notes and Bonds in auctions. The bond market hated the announcement and pushed rates higher in anticipation of even more bonds that must get sopped up at weekly Treasury auctions.

U.S. Debt Downgraded

The bond market was not the only thing that didn't like the Treasury Department's call for more money. Fitch Ratings downgraded US Debt one notch from AAA to AA+. They cited "fiscal deterioration" over the next three years as the driver behind the decision.

Our debt was downgraded back in August 2011, for many of the same reasons which were rising debt, political division, etc. But this time things are slightly different. Back in 2011, we had just $6T in government debt and today, we have over $32T in debt.

We do have some history on our side. Back in 2011, after the debt was downgraded, interest rates did improve in the months ahead. For the interest-rate sensitive housing sector, this would be a welcome development.

Japan Seeing Higher Rates

The Bank of Japan (BOJ) has started to loosen their Yield Curve Control (YCC) policy by allowing their 10-yr government bond to float from a cap of .50% to 1.00%. This is a big change from a government that had pinned rates at 0.0% for years. As the Japanese interest rates crept higher upon the announcement, it placed upward pressure on our rates as well.

4.09%

On Thursday, the 10-yr Note was right at an important level of 4.09%, which has been serving as yield resistance, preventing rates from moving higher since November. If the 10-yr moves above this level, we could easily see home loan rates move another leg higher still.

Bottom line: The financial markets were unnerved by the double whammy of surprises with the Treasury's request for more money and the subsequent debt downgrade. Time will tell whether rates can reverse from key levels like it had since November or will we see yet another leg higher in rates.

Looking ahead

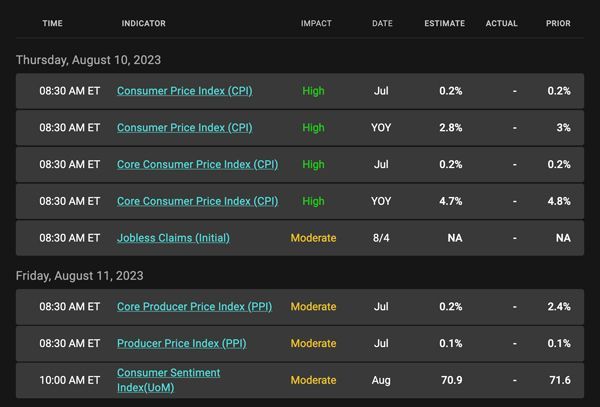

Next week will deliver one of the 5 key reports the Federal Reserve said to watch prior to the next Fed Meeting in September...the Consumer Price Index or CPI. Last month, the June reading came in at 3.00%, which was well off the June 2022 reading of 9%. If the reading comes in higher than expected, rates could move higher. The opposite is true.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 6.0% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

On the right side of the chart, you can clearly see how prices are hovering right near 100. If the bond falls beneath this key level, we will see home loan rates climb higher once again. The opposite is true.

Chart: Fannie Mae 30-Year 6.0% Coupon (Friday, August 4, 2023)

Economic Calendar for the Week of August 7 - 11

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

Registered Mortgage Broker-NYS Department of Financial Services

All mortgage loans arranged with third party providers.

NYS, CT, NJ, FL Department of Financial Services

Bob Moulton, Mortgage Broker | All Rights Reserved | Accessibility & Privacy Policy | Powered by PS Digital